√1000以上 2290 form irs.gov 430795-2290 form irs.gov

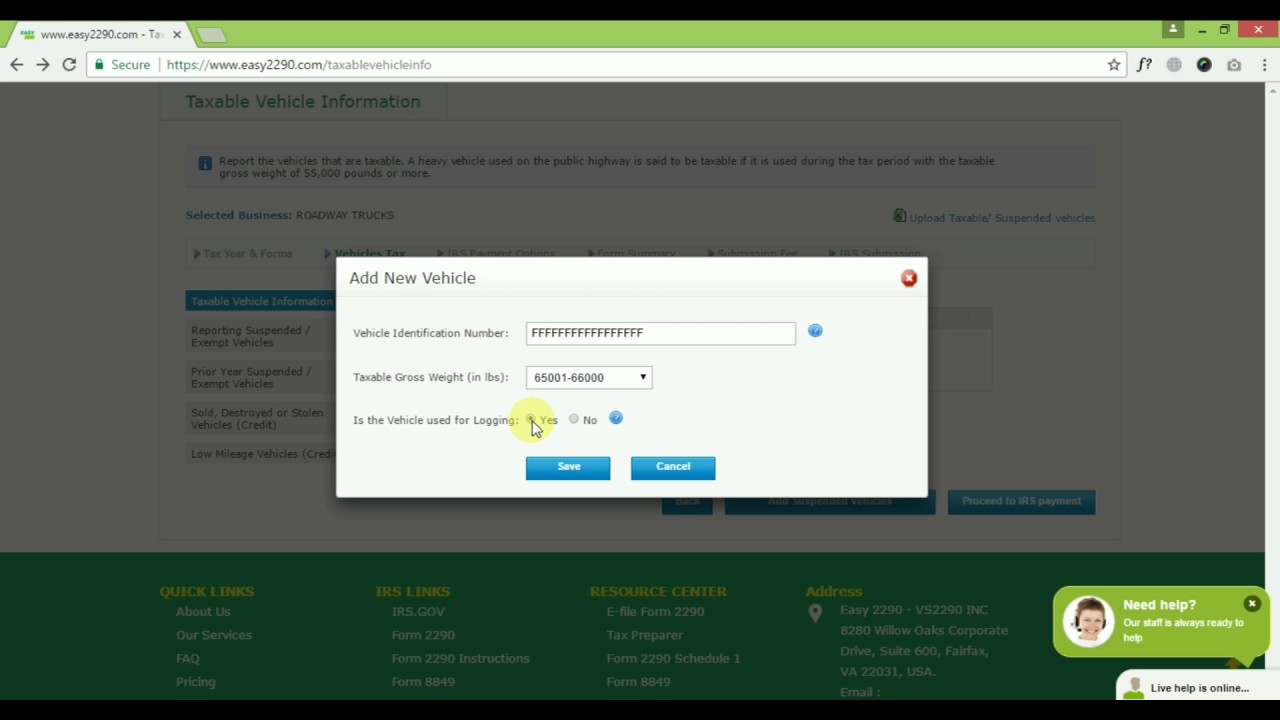

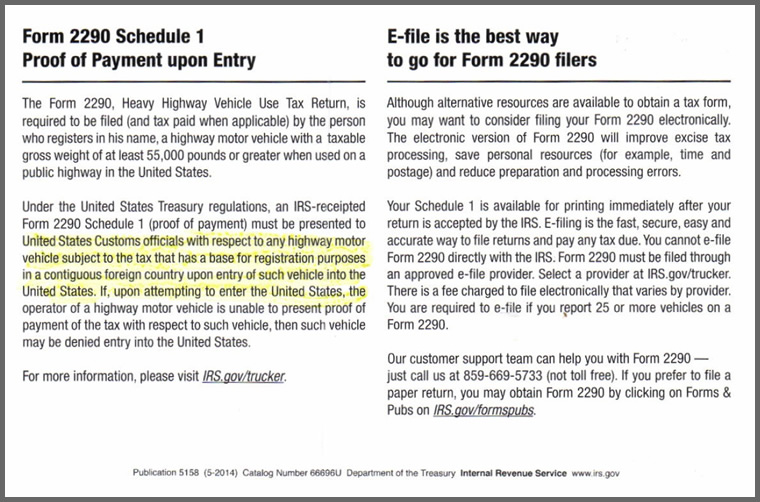

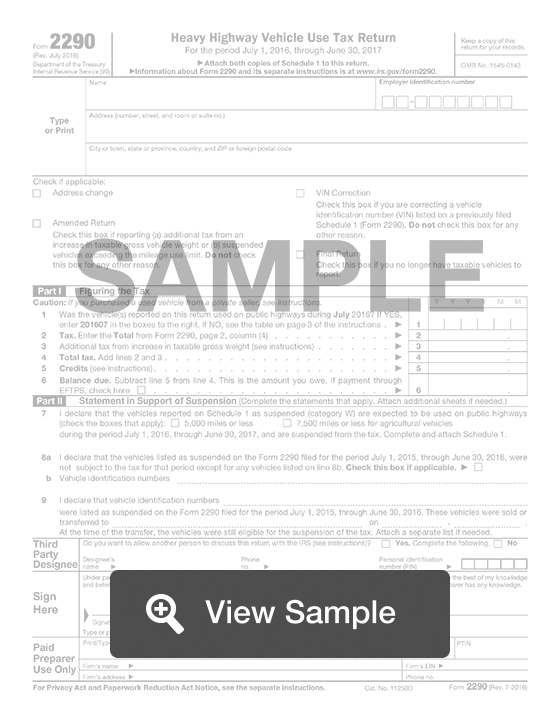

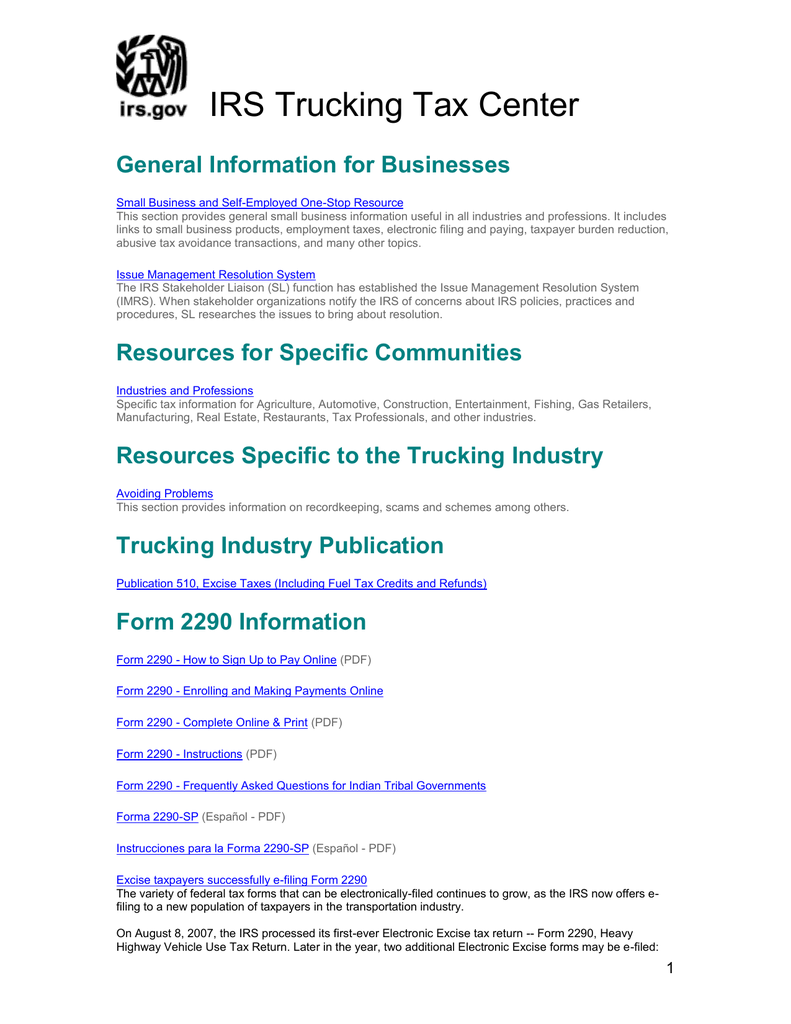

File your IRS Form 2290 Online electronically, save time and money, and reduce preparation and processing errors Submit your 2290 return online and get your IRS Form 2290 Schedule 1 through our website within minutes No more waiting in line at the IRS or waiting for it to come in the mail!Inst 2290 Instructions for Form 2290, Heavy Highway Vehicle Use Tax Return 0721 Form 2290 (SP) Declaracion del Impuesto sobre el Uso de Vehiculos Pesados en las Carreteras 0721 Form 2290 (SP)Form 2290 is used to figure and pay the tax due on highway motor vehicles for any taxable period with a taxable gross weight of 55,000 pounds or moreIt is much simpler and easier to file your 2290 through an IRSapproved software provider 3 easy steps to file your form 2290 safe and secure online 1

Irsnews Irs Is Offering An Overview Of The Form 2290 Heavy Highway Vehicle Use Tax For Details And To Sign Up For This Free Webinar Visit T Co Lctiqxgnog T Co 3jdjdjehnl

2290 form irs.gov

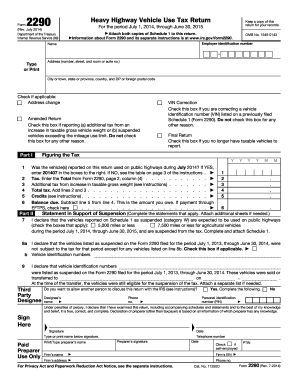

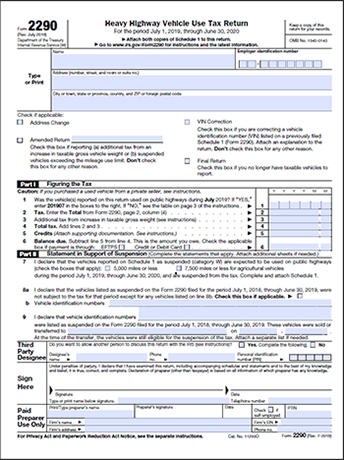

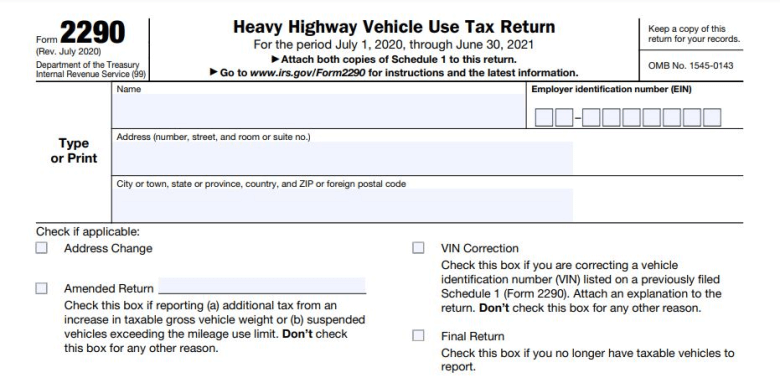

2290 form irs.gov-Complete Form 2290V if you are making a payment by check or money order with Form 2290, Heavy Highway Vehicle Use Tax Return We will use Form 2290V to credit your payment more promptly and accurately, and to improve our service to youJun 25, 21 · Form 2290 is used for reporting and paying the tax for the heavy highway vehicle use on public roads and is meant for vehicles that exceed the taxable weight of 50,000 pounds or more Form 2290 should be filed between July 1 st, 21, and June 30 th, 22 to prevent late fines and penalties, but the best practice is to prefile the Form between

How To E File Form 2290 For 21 Tax Period

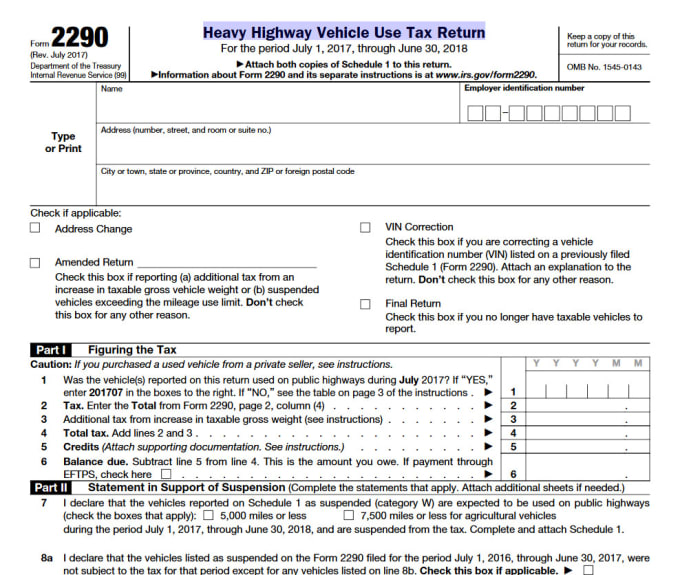

Form 2290 and its instructions, such as legislation enacted after they were published, go to IRSgov/Form2290 Reminders Payment through credit or debit card Form 2290 filers are able to pay their Form 2290 tax liability with either a credit or debit card See Credit or debit card under How To Pay the Tax, later, for more informationWe offer a safe and secure option to submit your IRS form 2290 Filing with us keeps you in the IRS's good graces and out of trouble PaperFree Management Unlike the traditional ways of submitting your taxes, there's no waiting after the mail delivery No more waiting after your2290 EFile Process If you aren't using an online efile solution for the IRS Form 2290 heavy vehicle taxes, the process can be confusing and frustrating We provide a simple stepbystep automated system so you can get back to your business in no time Businesses across the country trust us for a quick and hasslefree solution for all their

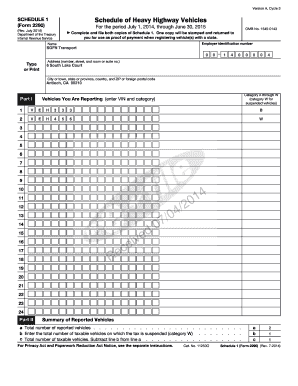

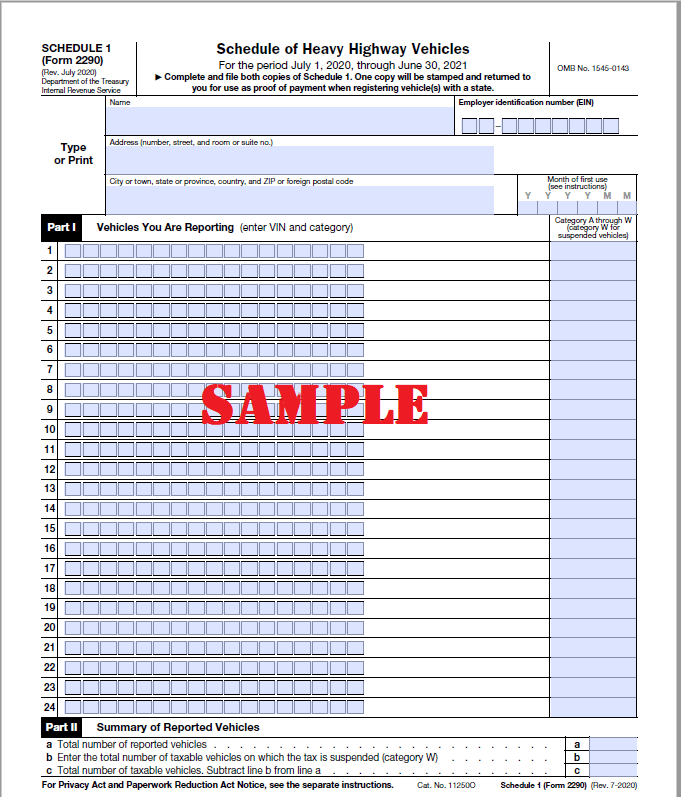

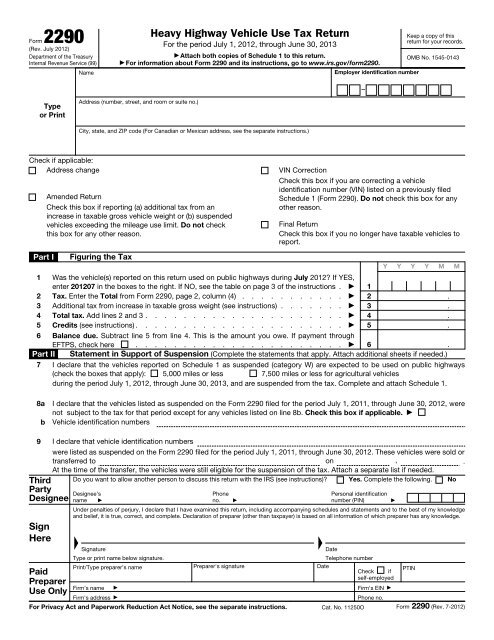

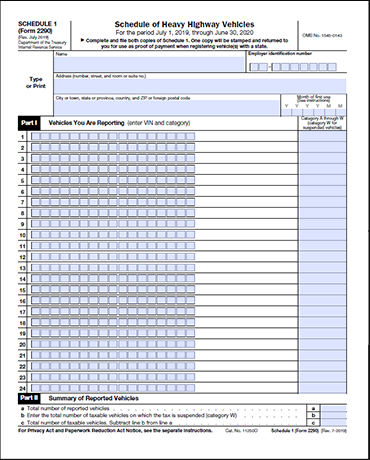

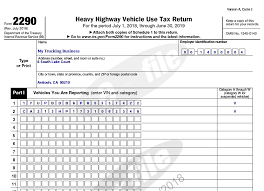

IRS Form 2290 There is a requirement that the Internal Revenue Service (IRS) form 2290Schedule 1, "Schedule of Heavy Highway Vehicles" must be submitted for all power units with a registered weight over 54,000 lbs GVW Return the most current stamped copy of Schedule 1 (applicable year) Copies of the form 2290 may be obtained at thisIRS Form 2290 amendments can be reported to the IRS Online VIN Correction, Increase in Taxable Gross Weight of Vehicle, Suspended Vehile Exceeded Mileage Limit Toggle navigation FORM 2290 Login Pricing FAQ Contact Live Chat IRS Form 2290Aug 27, · Efile 2290 Starting at $990 EFile 2290 Now Why EFile 2290 with ExpressTruckTax?

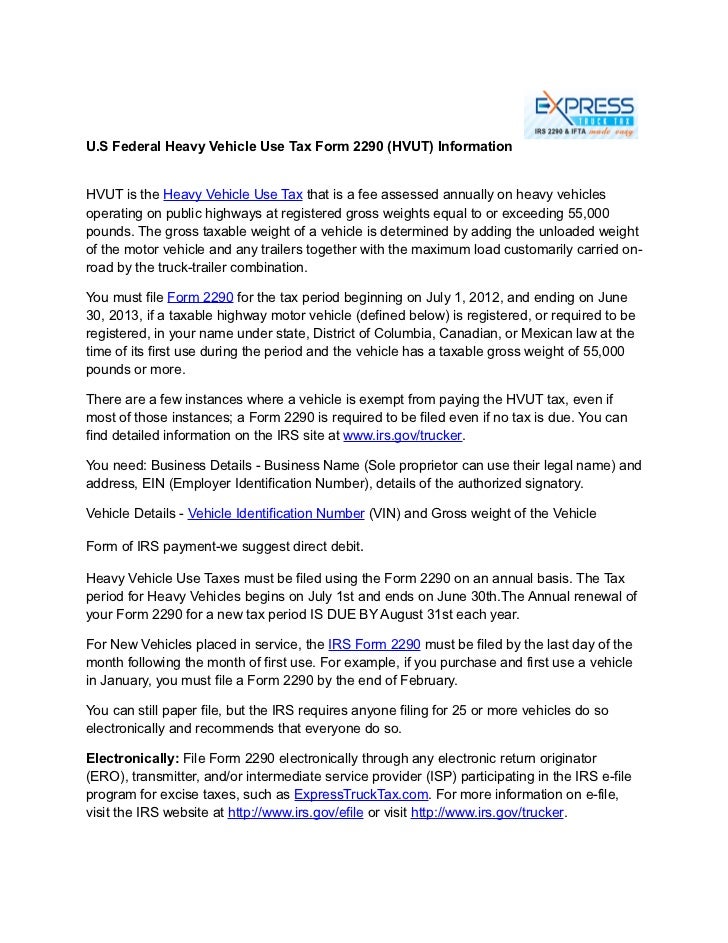

IRS Form 2290, Heavy Vehicle Use Tax(HVUT) is a Federal Excise Tax that is imposed on heavy weight highway vehicles with gross weight of 55,000 pounds or more Owners of the heavy weight vehicles must file the Heavy Vehicle Use Tax(HVUT) annually through filing 2290 Form online and get their Stamped Schedule 1 This Tax is applicable forForm 2290 (Rev July ) Department of the Treasury Internal Revenue Service (99) Heavy Highway Vehicle Use Tax Return For the period July 1, , through June 30, 21 Attach both copies of Schedule 1 to this return Go to wwwirsgov/Form2290 for instructions and the latest information Keep a copy of this return for your recordsJun 30, 21 · Date Posted 1/14/21 The United States federal heavy vehicle use tax (HVUT) must be filed by motor carriers operating vehicles that have a taxable gross weight of 55,000 pounds or more To register, Form 2290 must be submitted to the Internal Revenue Service (IRS) Following the five steps below can make quick work of filing your returns

Irs Form 2290 Online Filing Steps Irs Forms Irs Efile

No More Paper Reminders Will Be Mailed By Irs For Form 2290 Heavy Highway Vehicle Use Tax Return By Steve Sanders Issuu

The truckers prepare their IRS Tax Form 2290 and report the HVUT on heavy vehicles with the taxable gross weight of 55,000 pounds or more The taxable heavy vehicles include the truck tractors, trucks and buses The HVUT rate is $550 per vehicle, which is based on the gross weight of the vehicle's category and the mileage usage limit(5,000 miles for general heavy vehicle andJun 30, 11 · File Form 2290 electronically through a provider participating in the Internal Revenue Service (IRS) efile program for excise taxes Once your return is accepted by the IRS, your stamped Schedule 1 can be available within minutes For more information on efile, visit IRSgov/eFileProviders/eFileForm2290 or visit IRSgov/TruckerIRS 2290 schedule 1 IRS needs two copies of schedule 1 This needs to be duly filled and submitted to the IRS along with the filled in copy of the Form 2290 while filing The IRS will stamp one copy and return to you for use as proof of payment when

Search 24 Printable Irs Form 2290 Templates Fillable Samples In Pdf Form 2290 Heavy Highway Vehicle Use Tax Return Irs Form 2290 Free Download Edit Fill Create And Print Form 2290 Heavy Highway Vehicle Use Tax Return 24 Printable

Tax Office Traviscountytx Gov Files Vehicles 2290 Pdf

Welcome to eForm2290 Login Page We are an IRS approved efiling service provider Use our 2290 online login to file your truck tax for 21 with ease!Requirements to File IRS Form 2290 Any heavy trucks that operate on the public highways are subjected to Federal Excise Tax called as IRS Form 2290 A tuck that weighs 55,000 pounds or more and is used to 5000 miles or more must pay this federal tax This tax is collected annually and the same is used for maintenance and construction of highways2290 Tax Service is an IRS authorized efile service provider;

Office Of Highway Policy Information Policy Federal Highway Administration

2

IRS Form 2290 TaxExempt Vehicles Highway motor vehicles that have a taxable gross weight of 55,000 pounds or more are taxable To be exempt from the tax, a highway motor vehicle must be used and actually operated by A nonprofit volunteerYou must file Form 2290 and Schedule 1 for the tax period beginning on July 1, , and ending on June 30, 21, if a taxable highway motor vehicle (defined below) is registered, or required to be registered, in your name under state, District of Columbia, Canadian, or Mexican law at the time of its first use during the period and the vehicle has a taxable gross weight of 55,000 pounds or moreIf you are efiling your return through eForm 2290, you can file a 2290 amendment for increase in 'taxable gross weight increased' section For this, you will need to specify your VIN, month of weight increase, the old weight and the new weight You will also need to indicate if

Etrucktax Form 2290 Filing

Search 24 Printable Irs Form 2290 Templates Fillable Samples In Pdf Form 2290 Heavy Highway Vehicle Use Tax Return Irs Form 2290 Free Download Edit Fill Create And Print Form 2290 Heavy Highway Vehicle Use Tax Return 24 Printable

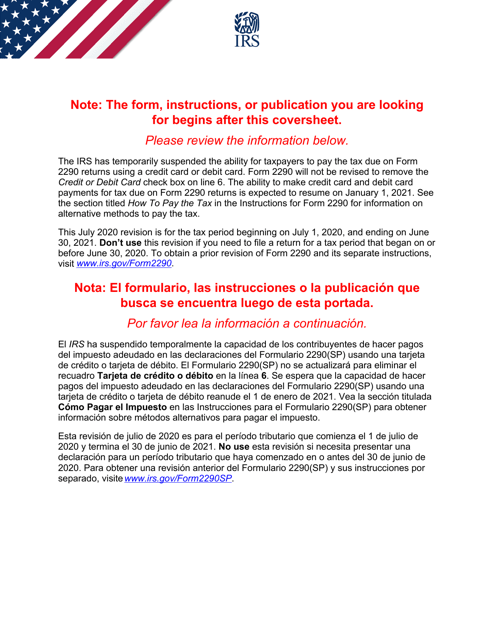

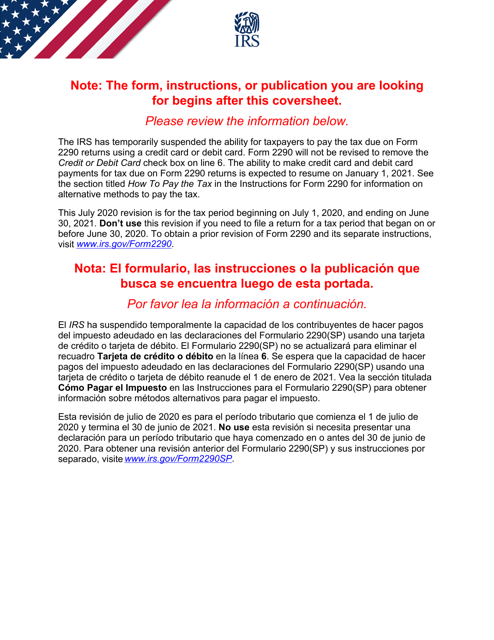

Filing 2290 form online is simple, secure and easy We, at 2290form, have simplified the process to file 2290 form online These are the steps you need to follow when filing IRS HVUT Choose your 'Business' Select the 'Tax Period' and 'First Used Month' of your vehicle Enter the vehicle information Make the paymentMay 31, 21 · Any trucker with a vehicle that has a taxable gross weight of 55,000 pounds or more must use Form 2290 to figure and pay HVUT with the IRS every tax year Heavy Vehicle Use Tax (HVUT) is a fee assessed annually on heavy vehicles operating on public highways Usually the tax period begins on July 1, and ends on June 30Caution The 2290 form or instruction you are looking for begins on the next page But first see the important information below The IRS has temporarily suspended the ability for taxpayers to pay the tax due on Form 2290 returns using a credit card or debit card Form 2290 will not be revised to

Help Videos Easy2290 Makes Filing Your Taxes More Simple Than Ever Before

How To E File Form 2290 For 21 Tax Period

2290 Tax Form Heavy Automobile Owners IRS Tax Form 2290 must be filed annually from July 1st to August thirty first September third for 19 for all registered autosForm 2290 is an IRS tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more The IRS mandates that everyone who owns a heavy vehicle with 5000 miles or above in the odometer should file their form 2290 before the due datePurpose of IRS Form 2290 The form 2290 is used mainly for the following scenarios For the payment of any tax dues for highway motor vehicles that are over 55,000 pounds in gross weight Any vehicle with tax due and completed suspension statement on another Form 2290 The vehicle should have exceeded the mileage use limit during the taxation

24 Printable Irs Form 2290 Templates Fillable Samples In Pdf Word To Download Pdffiller

Pin On Trucks

Form 2290 Filing Requirements When Registering a Heavy Highway Vehicle Within 60 Days of Purchase Generally, you must file Form 2290, Heavy Highway Vehicle Use Tax Return, and pay the appropriate tax if you are registering in your name a heavy highway motor vehicle with a gross weight of 55,000 pounds or moreMar 12, 21 · You cannot efile your Form 2290 on IRSgov You must use one of the participating commercial software providers Follow the software prompts to complete, sign and efile your return Caution The thirdparty provider you choose toManaging time is very important with trucking business Pre Filing is managing time with your Form 2290 tax filing, advancing the tax preparation and completing HVUT returns for the tax year 21 – 22 now and submitting in the website We shall be holding it until the IRS starts processing 2290 taxes for the 21 – 22 tax year in the first week of July

Faq S For Truckers Who E File Irs Form 2290

Irs Offers Free Webinar For Heavy Vehicle Highway Use Tax Form 2290 Alabama Trucking Association Alabama Trucking Association

Aug 31, · The Internal Revenue Service sent a notice to states regarding the enforcement of Form 2290 payments "Due to the current health crisis, taxpayers who filed a paper Form 2290 to report and pay the highway use tax for the taxable period July 1, , through June 30, 21, can expect a significant delay in receiving their IRSstamped Form 2290Jun 14, 21 · Form 2290 Deadline and PreFiling HVUT Every truck owner should bear in mind to file IRS 2290 form for each tax year Every year the tax season is from 1 st July to June 30 th Truckers are aware that August 31 st is the deadline for filing HVUT tax Logging into Tax2efilecom is a smart way for efiling form 2290 thereby averting penaltiesJul 01, 21 · According to the IRS rules and regulations, a trucker must choose to efile an HVUT return when filing more than 25 tax returns for a tax period When you're efiling Form 2290 choose an IRS authorized efile provider like Form 2290 Filing Next, gather the required information beforehand to file HVUT returns online This includes business

24 Printable Irs Form 2290 Templates Fillable Samples In Pdf Word To Download Pdffiller

Best Of Irs Gov Tax Forms 2290 Models Form Ideas

File Form 2290 which is your Heavy Vehicle Use Tax (HVUT) Return with IRS trusted efile 2290 provider Grab upto 75% off on filing 2290 online & get schedule 1 in minutesForm2290com is an IRS Authorized EFile provider for Heavy Vehicle Use Tax Quick and secured way to prepare your truck tax return Get Schedule 1 in minutes Automatic tax calculationJul 02, 21 · How to avoid these common mistakes in 2290 filings, and fees Also update on report about multiple efile companies on IRS list operating

2

21 Irs Printable Form 2290 Fill Download 2290 For 6 90

Form 2290 filing is required if the truck has a gross vehicle weight (GVW) of 55,000 pounds or more and the truck is used on a public highway If you have a truck you use for 5,000 miles or less 7,500 for farm trucks you are required to file an HVUT return, but you won't need to pay the heavy vehicle use taxIRS 2290 schedule 1 IRS needs two copies of schedule 1 This needs to be duly filled and submitted to the IRS along with the filled in copy of the Form 2290 while filing The IRS will stamp one copy and return to you for use as proof of payment whenIRS schedule 1 Tax tips IRS help IRS needs two copies of schedule 1 This needs to be duly filled and submitted to the IRS along with the filled in copy of the Form 2290 while filing The IRS will stamp one copy and return to you for use as proof of payment when registering vehicle (s) with a state After efiling the Form 2290 along with

Www Dot Nd Gov Divisions Mv Docs 2290filinginstructions Pdf

19 Printable Form 2290 16 17 Templates Fillable Samples In Pdf Word To Download Pdffiller

#1 IRS 2290 Efile Provider Get Stamped Schedule 1 in Minutes Guaranteed Schedule 1 or your Money Back Free 2290 VIN Correction USbased support in both English & Spanish Pricing starts at $990Jan 30, · For the 2290 Schedule 1Copy, you must be File 2290 Heavy Vehicle Use Tax Form Online and pay 2290 Highway Tax Amount While the 2290 Online Filing process, you have to enter your personal details, business information, and your truck detailsIRS schedule 1 Tax tips IRS help IRS needs two copies of schedule 1 This needs to be duly filled and submitted to the IRS along with the filled in copy of the Form 2290 while filing The IRS will stamp one copy and return to you for use as proof of payment when registering vehicle (s) with a state After efiling the Form 2290 along with

Irsnews Irs Reminder Taxpayers With 25 Or More Taxed Vehicles Must Now Efile Highway Use Tax Form 2290 More At T Co 02cepoarrr T Co Vie4xsrhbk

E File Form 2290 19 Online Get Schedule 1 Irs Irs Taxes Filing Taxes

Jun 25, 21 · About Form 2290, Heavy Highway Vehicle Use Tax Return Use Form 2290 to Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more;EForm2290 is an IRS authorized efile service provider for safe & secure filing of truck taxes File IRS form 2290 with us & Use ROAD to get % off!When you sign up with i2290com, you can Prepare and efile your Heavy Vehicle Use Tax return File electronically online anytime, anywhere Save time—no more waiting in long lines at the IRS office to file Save money—flatrate pricing with no surprises or hidden addon costs Print your stamped Schedule 1 in just minutes

Http Www Tax2290 Com Download F2290v4 Pdf

Irs Watermarked 2290 Proof Of Payment Schedule 1in Minutes Tax2290 Com

Form 2290 must be filed for each month a taxable vehicle is first used on public highways during the current period The current period begins July 1, 09, and ends June 30, 10 Form 2290 must be filed by the last day of the month following the month of first use The filing rules apply whether you are paying the taxFor your security, we automatically logged you out Please Login Again * Email EmailForm 2290, heavy vehicle use tax return is used to figure and pay taxes for the vehicles with the taxable gross weight of 55,000 pounds or more Form 2290 is also required when the acquisition of used vehicles is done for the current tax period

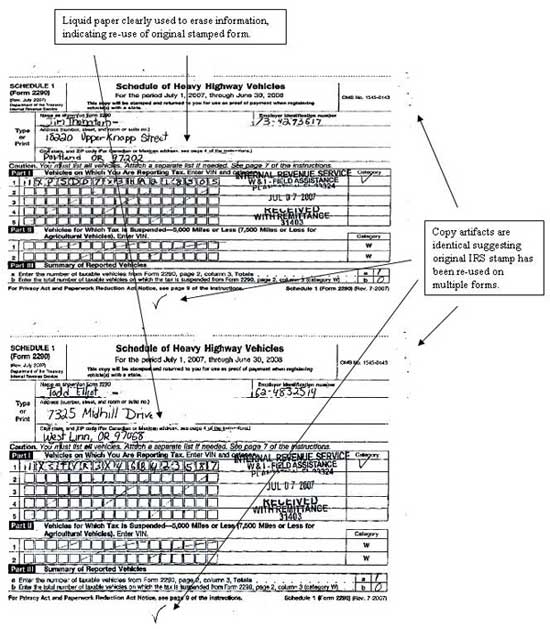

3 11 23 Excise Tax Returns Internal Revenue Service

Form 2290 Heavy Highway Vehicle Use Tax Return

Form 2290 Heavy Highway Vehicle Use Tax Return

Truck Tax Center Online Platform To E File 2290 Starts At 7 99

So Konnen Sie Ihre Steuern Fur Online Einreichen Und Bezahlen Moyens I O

Schedule 1 Irs Form 2290 Proof Of Payment Epay2290 Com

File Irs Form 2290 Online With Eform 2290 Irs Forms Irs Truck Driver

2

Heavy Vehicle Use Tax With Irs Tax Form 2290

Search 24 Printable Irs Form 2290 Templates Fillable Samples In Pdf Form 2290 Heavy Highway Vehicle Use Tax Return Irs Form 2290 Free Download Edit Fill Create And Print Form 2290 Heavy Highway Vehicle Use Tax Return 24 Printable

Www Irponline Org Resource Resmgr Events2 Irs Assistance Cards Templat Pdf

Schedule 1 Form 2290 Proof Of Hvut Payment Eform2290 Irs Forms Irs Schedule

Irs Stimulus Payments On Their Way Visit Irs Gov Instead Of Calling Koam

3 12 2 Error Resolution System For Excise Tax Returns Internal Revenue Service

Irs Labor Day Shut Down

Irs Form 2290 Questions Fill Online Printable Fillable Blank Pdffiller

24 Printable Irs Form 2290 Templates Fillable Samples In Pdf Word To Download Pdffiller

Irs Form 2290

2

Form 2290 Rev July 12 Internal Revenue Service

Etrucktax Form 2290 Filing

2290 Tax Form Get Irs Form 2290 Printable Filing Sample Online

Www Cooperative Com Conferences Education Meetings Tax Finance Accounting Conference Eventmedia Page31 Bo5c form 2290 excise tax and heavy vehicles other considerations dunn Pdf

I R S F O R M 2 2 9 0 Zonealarm Results

2

3 11 23 Excise Tax Returns Internal Revenue Service

Download Instructions For Irs Form 2290 Heavy Highway Vehicle Use Tax Return Pdf Templateroller

What Is Irs Tax Form 2290

Office Of Highway Policy Information Policy Federal Highway Administration

Search 24 Printable Irs Form 2290 Templates Fillable Samples In Pdf Form 2290 Heavy Highway Vehicle Use Tax Return Irs Form 2290 Free Download Edit Fill Create And Print Form 2290 Heavy Highway Vehicle Use Tax Return 24 Printable

Irs Form 2290 Download Fillable Pdf Or Fill Online Heavy Highway Vehicle Use Tax Return Templateroller

Pre File 21 22 Form 2290 Now Pay Hvut Later

Trucker Tax Deadline Coming Aug 31 Cpa Practice Advisor

I R S F O R M 2 2 9 0 Zonealarm Results

Faq On Irs Form 2290 Heavy Vehicle Use Tax Irs Tax Forms 2290

Irs Form 2290 Download Fillable Pdf Or Fill Online Heavy Highway Vehicle Use Tax Return Templateroller

Office Of Highway Policy Information Policy Federal Highway Administration

U S Federal Heavy Vehicle Use Tax Form 2290 Hvut Information

Irs Form 2290 Instructions 21 22 What Is Form 2290

Form 2290 Instructions In Normal People Language

Irs Form 2290 Truck Tax Return Fill Out Online Pdf Formswift

Irs 2290 Payment To Irs Pay Online Using Efw Or Eftps Check Or Money Order

Irsnews Irs Is Offering An Overview Of The Form 2290 Heavy Highway Vehicle Use Tax For Details And To Sign Up For This Free Webinar Visit T Co Lctiqxgnog T Co 3jdjdjehnl

I2290 United Parcel Service Internal Revenue Service

What Do You Need To File Irs Tax Form 2290 Online Irs Tax Forms Tax Forms Employer Identification Number

2290 Form Faq Heavy Vehicle Use Tax Irs Tax Form 2290 And 49

Calameo E File Irs Forms 1099 Misc 1099 Div 1099 Int Irs Authorised

1

Download Instructions For Irs Form 2290 Heavy Highway Vehicle Use Tax Return Pdf Templateroller

Best Of Irs Gov Tax Forms 2290 Models Form Ideas

Tax Cdkeysdirect Com

Search 24 Printable Irs Form 2290 Templates Fillable Samples In Pdf Form 2290 Heavy Highway Vehicle Use Tax Return Irs Form 2290 Free Download Edit Fill Create And Print Form 2290 Heavy Highway Vehicle Use Tax Return 24 Printable

E File Form 2290 File 2290 Online 9 90 Quick Secure

New York Form 2290 Heavy Highway Vehicle Use Tax Return

2290 Highway Use Tax

Phishcheck 2 0 Beta Details Http Www Irs Gov

E File Form 2290 Hvut Filing Online Irs Form 2290 Pay Online 21 By Form2290filing Issuu

Search 24 Printable Irs Form 2290 Templates Fillable Samples In Pdf Form 2290 Heavy Highway Vehicle Use Tax Return Irs Form 2290 Free Download Edit Fill Create And Print Form 2290 Heavy Highway Vehicle Use Tax Return 24 Printable

68 Form 2290 Online Ideas Irs Forms Tax Forms Federal Taxes

Learn How To Fill The Form 2290 Internal Revenue Service Tax Youtube

Www Maine Gov Sos Bmv Forms Mv 2 heavy vehicle use tax 8 11 Pdf

Form 2290 Heavy Highway Vehicle Use Tax Return

Download Instructions For Irs Form 2290 Heavy Highway Vehicle Use Tax Return Pdf Templateroller

Hvut County Clerks Guide

How To File Your Own Irs 2290 Highway Use Tax Step By Step Instructions Youtube

Irs Form 2290 Online Heavy Vehicle Use Tax Hvut Return

3 11 23 Excise Tax Returns Internal Revenue Service

Heavy Highway Vehicle Electronically File Your Form 2290 Choose Between Convenient Ways To Pay Your Pdf Document

Download Instructions For Irs Form 2290 Sp Declaracion Del Impuesto Sobre El Uso De Vehiculos Pesados En Las Carreteras Pdf Templateroller

Best Of Irs Gov Tax Forms 2290 Models Form Ideas

File Your Form 2290 Electronically By Jhodgson Fiverr

3 11 23 Excise Tax Returns Internal Revenue Service

I R S F O R M 2 2 9 0 Zonealarm Results

Irs Form 2290 Taxes On Truckers

Faqs For Form 2290 Due Date Cost E Filing And More

U S Federal Heavy Vehicle Use Tax Form 2290 Hvut Information

コメント

コメントを投稿